The Minority Caucus in Parliament says the government’s “requests for tax exemptions running into several billions of Cedis are unconscionable, inordinate, and bear all the trappings of organized crime.”

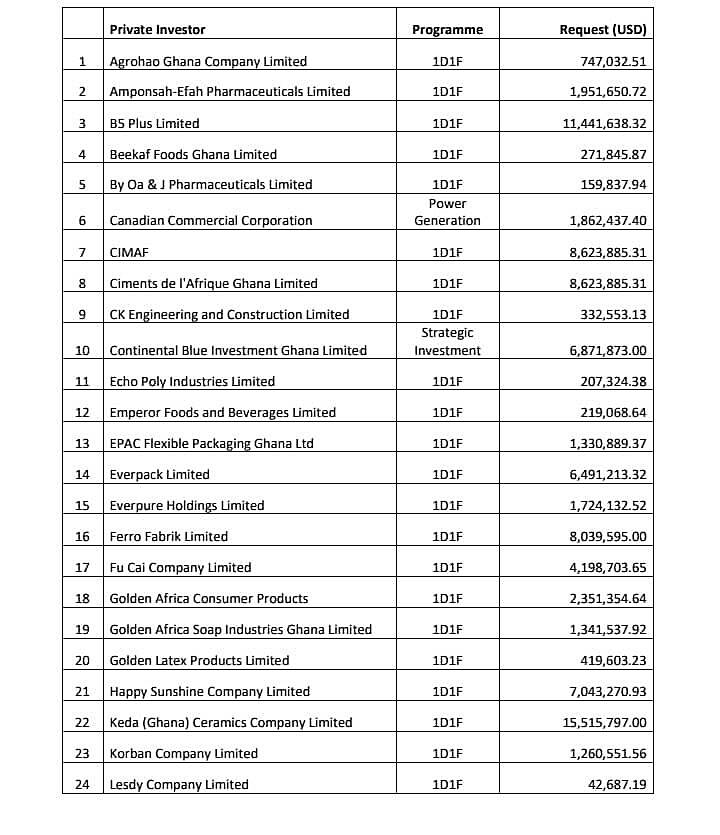

According to the Minority, about 45 companies have been presented to Parliament as one district-one-factory companies, GIPC strategic investors, among others, to be exempted from the payment of taxes.

In a statement issued on Monday, November 27, 2023, the Minority said the government was asking Parliament to grant tax exemptions to the tune of USD 449,446,247.95 for these 45 companies, which is equivalent to over half of GH¢5.5 billion.

The Minority stressed that this was an issue that significantly impacted the country’s economy and felt obligated to let “the Ghanaian taxpayer who is being burdened with all manner of taxes know this truth.”

It further disclosed that a total of 118 companies were being processed at the Ministry of Trade & Industry, Ministry of Finance, and the Ghana Investment Promotion Centre to be brought to Parliament for tax exemptions.

“The total value of exemptions for these 118 companies is about seven billion Ghana cedis,” it added.

The 45 companies indicated by the minority are listed below;