The Ghana Revenue Authority (GRA) announced that effective 1st July 2021, it will no longer receive cash at its office. The Authority encouraged Ghanaians to pay their taxes via mobile money only using *222# and/or via online through the Ghana.gov.gh platform.

With the introduction of the e-levy on mobile money and other electronic transactions, could mean that Ghanaians will have to pay taxes on their taxes.

This has led the director of the Africa Digital Economy Forum (ADEF) to question why the government is bent on imposing the new e-levy on all electronic transactions in the country.

He was speaking in an interview with Samuel Eshun on the Happy Morning Show when he said: “As the government has made this announcement, we understand and accept that we must pay taxes but the issue here is, the tool that is used to pay tax, is now being taxed as we pay tax. Our taxes are paid through mobile money and that is how you can widen the tax net. Now in paying taxes, we are going to be taxed in paying taxes and that is a problem.”

He added that it is as though the country takes one step forward with the digitalization agenda and three steps back when it makes such a decision as introducing e-levy on electronic transactions.

Derek shared that while taxes on mobile money transactions was expected, it was not expected at this time.

The government, as part of strategies to widen the country’s tax net, has announced a 1.75% Electronic Transaction Levy on all electronic transactions.

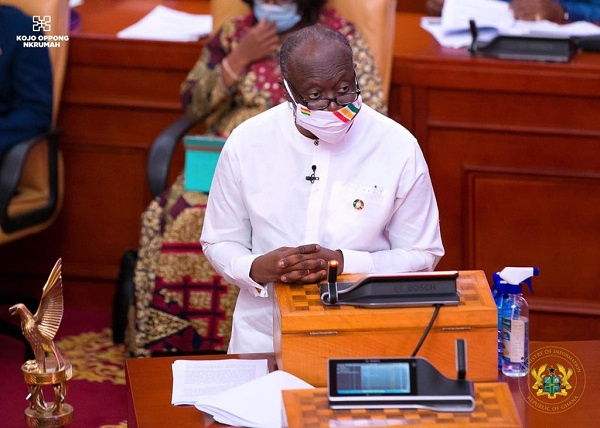

This fee, according to the Finance Minister, Ken Ofori-Atta, is to enhance financial inclusion and protect the vulnerable.

Transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances will have the levy imposed on them and will be borne by the sender.