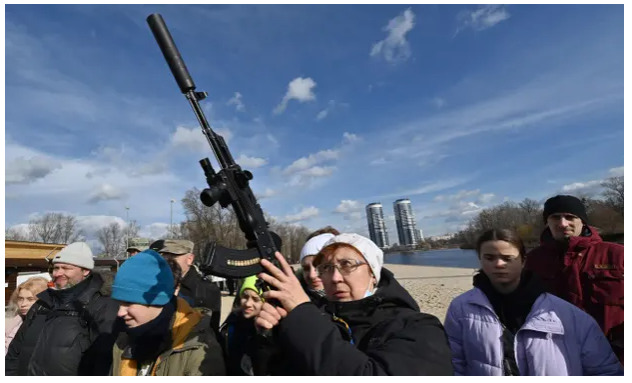

Ukrainians are buying guns, ammunition and sniper rifles ahead of a possible Russian invasion, with long queues inside weapons stores on Wednesday.

With a state of emergency set to be unveiled, the country’s parliament approved a draft law that gives Ukrainians permission to carry firearms. Previously they were forbidden from leaving home with lethal weapons.

Most Ukrainians – boys and girls – learn how to shoot at school. About 400,000 people are estimated to have combat experience, following Vladimir Putin’s 2014 annexation of Crimea and the Moscow-supported armed uprising in the east.

But the threat in recent days of a possible attack on Kyiv has caused an unprecedented rush to buy arms. Gun shops have sold out of some weapons, such as AR-10 and AR-15 assault rifles, with business now exceptionally busy.

“Of course I’m worried about the situation,” Dariia Olexandrivna said, speaking in the basement Praporshyk gun store, in central Kyiv’s Pushkin street. “I’m hoping for the best but preparing for everything.”

Olexandrivna said she and her husband began taking shooting lessons six months ago, when tensions with Moscow grew. They owned two handguns. She had come to buy 400 rubber bullets. “I saw Putin’s speech on Monday. I think he’s stupid enough to do it. He hates Ukrainian people,” she said.

Two weeks ago she packed the car with clothes, medicines, food, water and extra shoes. “My two children speak only Ukrainian. They don’t speak any Russian. If it’s no longer safe for us we will leave,” she said. Where would she go? “The west of the country, somewhere,” she replied.

Over the past 24 hours the Ukrainian government has taken enhanced security measures, having previously downplayed the likelihood of conflict. Restrictions on movement, mass gatherings, political meetings, and concerts and sports matches, are being proposed.

In a speech on Tuesday, the president, Volodymyr Zelenskiy, announced the mobilisation of reserves – beginning with 36,000 people, with veterans recalled to active duty. He also told Ukrainian citizens to leave Russia.Advertisementhttps://5402bb2e4c5e42faa909f302bc64539c.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html

Dmytro Skatrovsky said he had not been notified by text but had turned up anyway outside the Svyatoshynskyi recruitment centre, in western Kyiv. He spent three years in the army and took part in the 2014 battle to evict separatists from the port city of Mariupol, he said.

“I’ve bought two sniper complexes with good optics,” he added. “I’ve also ordered a drone on Amazon. It hasn’t turned up yet.” Skatrovsky said a group of friends had chipped in to get the rifles – at a cost of $10,000 (£7,370). US contacts had paid $2,300 for the drone, he said.

The Ukrainian military gave veterans guns, but the process was slow and bureaucratic, he explained. “We can win against Russia. This isn’t 2014,” he said. “We have heavy weapons, thanks to US and UK. If they come we will shoot at them from every window.”

Territorial defence courses, where ordinary citizens can learn to shoot are heavily oversubscribed. Buying a gun is legal so long as it more than 80cm in length, with weapons freely available.

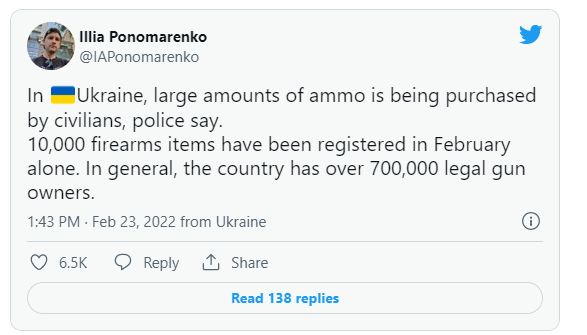

Police confirm Ukrainians are buying large amounts of ammunition. In February alone 10,000 firearms were registered. Overall, the country has more than 700,000 legal gun owners, the Kyiv defence reporter Illia Ponomarenko tweeted on Wednesday.

At the Stvol gun store around a dozen men were waiting patiently in front of a glass counter. The shop sells rifles, pistols, knives, and camping gear, as well as cumbersome safes and a medium-sized brass model of a wild boar. The owner said he had been told not to speak.Advertisement

One customer, Zhenya Nedashkvskyi, said he had dropped in to buy a pump action shotgun. “It won’t stop the Russians,” he admitted. “I want to protect my house from looters. The situation has become hot. It could get worse.”

Nedashkvskyi said he would like to protect his elderly parents who live in the city of Smila in the Cherkasy region, about 200km (124 miles) south of the capital. He said he had his eye on a Turkish-made Veryon model, costing 17,520 Ukrainian hryvnia – about $600. “I’ll get that or similar,” he said.

Ukraine’s former defence minister Andriy Zagorodnyuk said guns had long been part of national culture. “People are not storming petrol stations or stores but they are buying weapons to protect themselves. That’s a good sign.”

He added: It shows that the country is not scared. The nation is ready to fight, if it needs to.”

A few shoppers, however, said they were not worried about the situation or the prospect of a looming Kremlin offensive. Alex – a 23-year-old casino manager, who declined to give his second name – said he was buying a sniper file for his father, a keen hunter.

“I’m still calm,” he said. He added: “Guns are popular in Ukraine. We all get classes at school on how to shoot. My father has a big collection of weapons already. The rifle is a gift for him.”

Asked what would happen if Russian troops did turn up, he said: “I think our people will shoot back.”

Source: www.theguardian.com