Driven by the global pandemic, transactions increased by 65% during 2020

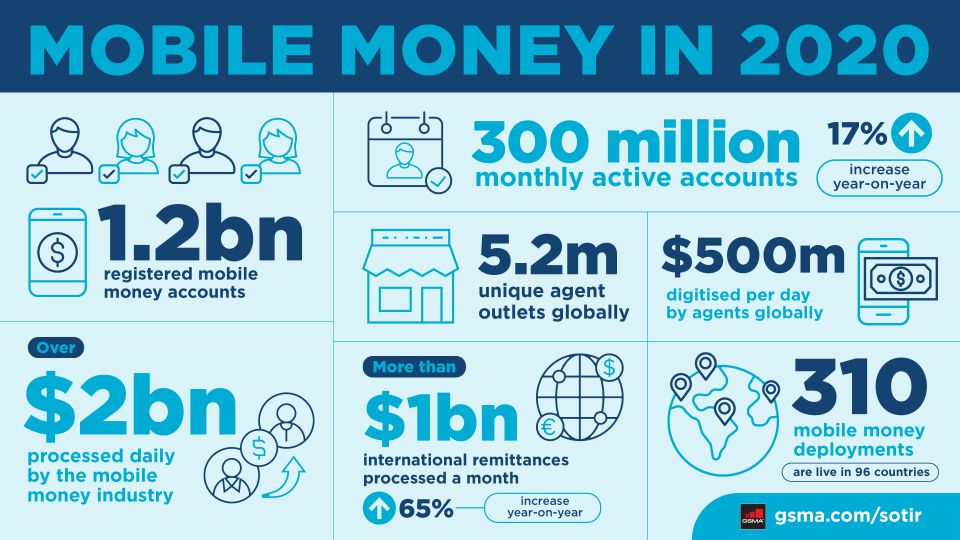

The GSMA has today published its annual ‘State of the Industry Report on Mobile Money’. It reveals a dramatic acceleration in mobile transactions during the COVID-19 pandemic as lockdown restrictions limited access to cash and financial institutions. The report found that the number of registered accounts grew by 13 percent globally in 2020 to more than 1.2 billion – double the forecast. The fastest growth was in markets where governments provided significant pandemic relief to their citizens.

Providing more opportunities in the formal economy

To minimise the economic toll of COVID-19, many national governments distributed monetary support to individuals and businesses. The value of government-to-person payments quadrupled during the pandemic, with the mobile money industry working hand-in-hand with administrations and NGOs to distribute social protection and humanitarian payments quickly, securely, and efficiently to those in need. Facilitating this type of direct income support payments is one example of how mobile money provides a financial lifeline to underserved communities. Mobile money providers have also provided in-kind support, including the distribution of personal protective equipment (PPE) and hand sanitising gel at agent counters.

Read also: “Mobile Money” – a gift to the Banking industry

“We see that mobile money is a powerful tool for expanding the financial inclusion of women in low- and middle-income countries,” said John Giusti, the GSMA’s Chief Regulatory Officer. “This year’s report, however, found that across markets women are still 33 percent less likely than men to have a mobile money account. The GSMA and its members are committed to closing this gender gap by addressing the barriers that prevent women from accessing and using mobile financial services.”

Closing the gap requires a collaborative and concerted effort. Many providers have committed to increasing the proportion of female customers. One example of an innovative approach to this is launching micro-entrepreneur products that can be used in markets where women represent the majority of vendors and customers.

Increasing global financial equality

For the first time, more than $1 billion was sent and received in the form of remittances globally every month via mobile money. Despite early fears that transactions would decline as people worldwide suffered job losses and income cuts during the pandemic, it remains clear that diasporas continue to support family and friends back home. As a result, the total value of transactions increased by 65 percent to an annual total of $12.7 billion in 2020.

In working towards achieving the Sustainable Development Goals (SDGs), the GSMA remains committed to reducing inequalities among countries when sending money internationally. According to GSMA’s research, mobile money provides an affordable channel for connecting people to vital financial resources. The mobile money ecosystem has been strengthened by an increasing number of strategic partnerships established between money transfer organisations and mobile money providers.

Read also: Vodafone partners UNDP, Access Bank to empower women(Opens in a new browser tab)

Driving regulatory change

As the COVID-19 pandemic negatively impacted people’s lives and weakened economies, regulators responded with a variety of measures aimed at reducing the impact. The research found that the pandemic gave fresh urgency to the need for regulatory change to facilitate greater digitalisation. In many markets, transaction limits were increased to allow more funds to flow through mobile money. Additionally, as demand rose for non-physical payments, some regulators classified mobile money agents and their supply chains as essential services. Over 50 percent of mobile money agents were continuously active throughout the pandemic, which was crucial for service continuity and maintaining liquidity.

While some of the regulatory reforms made in response to the pandemic have been positive for customers and providers, the implementation and extension of fee waivers have had a negative impact on mobile money providers’ core revenue stream. Mobile Money providers depend mainly on transactional revenues to sustain their business. Regulators are strongly encouraged to work closely with the industry to ensure sustainability going forward.

To find out more, download the 2021 ‘State of the Industry Report on Mobile Money’ here: https://www.gsma.com/mobilefordevelopment/resources/state-of-the-industry-report-on-mobile-money-2021. Further information on the GSMA’s Mobile Money programme is available at www.gsma.com/mobilemoney.