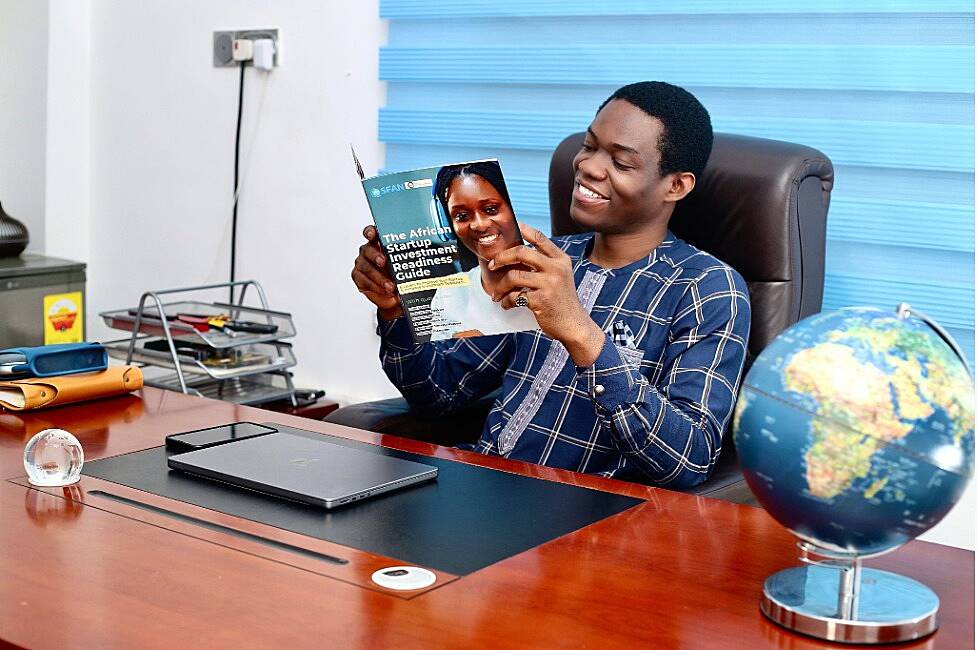

Ghana-based Stars From All Nations (SFAN), an education company that unlocks the potential of Africa’s young geniuses, has released the African Startup Investment Readiness Guide to help entrepreneurs get that money.

Investment readiness is the state or condition of a startup that makes it well-prepared and attractive to potential investors. It ensures you are fully prepared to approach potential investors with a solid business plan, financial projections, and a clear understanding of your market and competitors.

By assessing and enhancing various aspects of the business to ensure an affinity with investors’ demands before committing their financial resources to a company, you increase your chances of securing the funding you need to grow your business and achieve your goals.

The book, available in print and digital format, gives readers insights into Africa’s venture capital landscape, with 6 levers to increase their startups and make accessing VC funding easier.

The African Startup Investment Readiness Guide received contributions from investors and fund managers, including Tomi Davies, Damilola Thompson, Kenechi Okeleke, Ebinabo Joshua War Emmanuel Timassa Mumuni, and Adaeze Zita Edokwe on what they look for when making investment decisions. Plus, practical advice to helps startups avoid missteps that can block their funding prospects.

Regarding the book, SFAN President and Founder Tom-Chris Emewulu says: “I’ve had many entrepreneurs ask me for fundraising advice. And I’ve written about how I raised $250,000 pre-seed to pilot readyforwork.africa. As anyone that’s raised funding will tell you, fundraising is tough job. Regardless of how much you aim to raise. This new handbook, The African Startup Investment Readiness Guide, seeks to help startup founders: Understand what investors need from companies they fund, avoid missteps that make it impossible for funders to trust them, and make better investment decisions.”