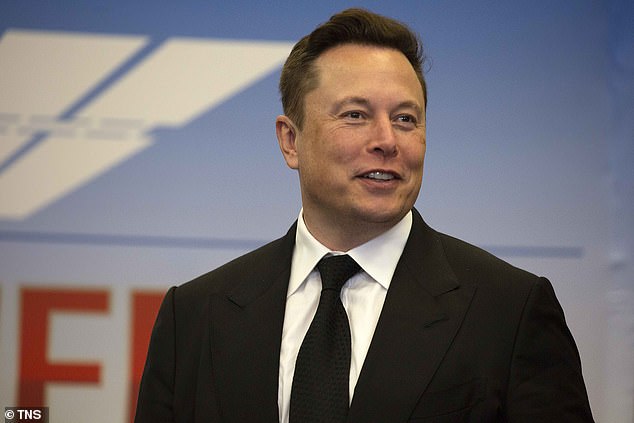

Tesla CEO Elon Musk has joined Twitter’s board of directors a day after disclosing that he took a 9 percent stake in the social media platform, prompting its stock value to surge by nearly 30 percent.

Twitter entered into an agreement with Musk on Monday that will give the billionaire a seat on its board, with the term expiring at its 2024 annual shareholders meeting, according to a Tuesday Securities and Exchange Commission (SEC) report obtained by DailyMail.com.

Musk, who has been highly critical of Twitter and its policies, said he is excited to ‘make significant improvements to Twitter in coming months!’

News of his board membership comes one day after Musk disclosed that he had purchased a 9.2 percent stake in Twitter Inc. on March 14, making him the social media platform’s largest shareholder.

Republican lawmakers on Monday praised Musk for protecting ‘free speech’ and alleged his share purchase was a warning about the social media giant’s ‘power.’ Others urged Musk to use his power to bring former President Donald Trump back to the platform after his account was taken down last year.

Musk has not spoken specifically about any Twitter rule changes he might push, however, the platform’s shares rose over 7 percent in premarket trading after Tuesday’s announcement.

After submitting the regulatory filing, Twitter CEO Parag Agrawal announced Musk’s board membership on the social media platform Tuesday morning, alleging the billionaire brings ‘great value’ to the company.

‘I’m excited to share that we’re appointing @elonmusk to our board! Through conversations with Elon in recent weeks, it became clear to us that he would bring great value to our Board,’ Agrawal wrote.

‘He’s both a passionate believer and intense critic of the service which is exactly what we need on @Twitter, and in the boardroom, to make us stronger in the long-term. Welcome Elon!’

Musk responded to the CEO, saying: ‘Looking forward to working with Parag & Twitter board to make significant improvements to Twitter in coming months!’

The billionaire, either alone or as a member of a group, won’t be allowed to own more than 14.9 percent of Twitter’s outstanding stock for as long as he’s a board member and for 90 days after.

News of Musk’s board seat comes amid allegations he broke SEC rules after missing the ownership-disclosure deadline for his stake in Twitter.

Musk, who has 80 million Twitter followers, purchased 73.5 million shares of the platform on March 14, worth about $3billion.

His shares represent a 9.2 percent passive stake in the company, according to the SEC 13G filing obtained by DailyMail.com.

However, the SpaceX CEO has left himself open to penalties of up to $207,183 after he failed to disclose his ownership acquisition within 10 days of acquiring 5 percent of the company, as required by U.S. securities law.

Musk should have disclosed his shares by March 24 but didn’t sign the filing until 21 days after his purchase.

While the civil penalty is a financial slap on the wrist for Musk, the world’s richest person with a $302billion net worth, according to Forbes, the entrepreneur could also face charges of market manipulation after his filing triggered a surge in the company’s stock value of more than 27 percent.

Twitter stocks have surged since mid-March when Musk purchased his stake. His shares, valued at around $2.4 billion at the closing price of March 14, jumped to $3.7 billion as of Monday’s closing price.

Experts allege investors on Monday were likely bidding shares higher on the chance that Musk’s stake could lead to a something big within the company.

Typically, when filing a 13G report – which is reserved for passive investors – shareholders include certification indicating they didn’t acquire the stake to change or influence control of the company, The Wall Street Journal reported.

Musk, however, didn’t include the certification in his form and instead simply wrote: ‘Not applicable’.

The billionaire has been critical of Twitter and its policies of late, accusing the company of failing to adhere to free speech principles.