Management of defunct GN Bank has explained that its decision to operate as a savings and loans company was because it still wants to operate as a Ghanaian institution aimed at promoting financial inclusion and serving the needs of ordinary Ghanaians.

The Bank of Ghana (BoG) on Friday announced that the bank had opted to operate as a savings and loans company after it failed to meet the minimum capital of GH₵400 million by December 31, 2018.

Following that, a statement signed by the Head of GN Corporate Affairs, Frank Owusu-Ofori, explained that the decision of the bank stemmed from conditions laid down by foreign investors at the time that they were searching for additional capital to meet the GH₵400 million capital requirement.

“It is necessary for us point out that in the process of looking for additional capital, we made a conscious decision not to sell our bank to mostly foreign interests. These investors wanted the retail network we have built, but with the intention to abandon our vision of promoting financial inclusion and serving the needs of ordinary Ghanaians. We have been honest about who we are – a Main Street Bank and not a High Street Bank,” the statement said.

Nonetheless, the statement added that they have started the transition process in order to deliver products and services beyond excellence as a savings and loans company.

Below is the full statement

“GN Bank Will Remain Ghanaian, With A National Retail Network, To Promote Financial Inclusion.”

The Shareholders, Directors and Management of GN Bank wish to inform our cherished customers and the general public that we have elected to continue our operations as a Savings & Loan Institution. This means that our doors will remain open for business as usual in January, 2019 and beyond. We have started the transition process. Our immediate objective is to find the liquidity needed to service the needs of our customers.

This means that as a licensed deposit taking institution, customer funds remain safe with us. The decision allows us to concentrate on ensuring maximum liquidity to sustain the business, instead of raising funds for additional capital as a universal bank. We operated in the recent past successfully as a Savings and Loan Company for eight years, so we can assure our customers that with our attention back to managing the business, instead of combing the world for additional capital, we are poised to deliver products and services beyond excellence.

It is necessary for us to also point out that in the process of looking for additional capital, we made a conscious decision not to sell our bank to mostly foreign interests. These investors wanted the retail network we have built, but with the intention to abandon our vision of promoting financial inclusion and serving the needs of ordinary Ghanaians. We have been honest about who we are – a Main Street Bank and not a High Street Bank.

We formed the company and started looking for a license in 1997 to create a national bank for all Ghanaians wherever they may live, capable of ensuring financial inclusion and bringing the unbanked into the formal sector. It took the founding shareholder, Coconut Grove Beach Resort, nine years and a lot of effort, to obtain a license from the Bank of Ghana on May 8, 2006 to operate as a Savings and Loan Company under the brand name, First National Savings & Loans Company Limited. Coconut Grove was joined by another Ghanaian shareholder, BB Acquisitions. Other shareholders have subsequently invested in the company.

Our financial institution has two intertwined branches – traditional banking and Micro-Enterprise business. The power of the two makes us unique and special. It took hard work to be where we are, with 1.2 million customers and 20% of the Ghanaian banking retail outlets in Ghana

We invested heavily in opening offices in all the ten regions of Ghana. When we opened our doors, the unbanked population was 80%. Today, it has fallen to 55%. Our continued existence will ensure that the percent of the population that is unbanked will reduce further.

From the very beginning, Our Vision has been, “To be a truly National Bank for the Ordinary person namely; Farmers, Professionals, Students, Workers, and Small and Medium Scale Entrepreneurs in Ghana.”

We will continue to be a financial institution with a difference – go where others are not willing to go, to bring banking to people currently excluded from the formal banking sector throughout the country.

Signed

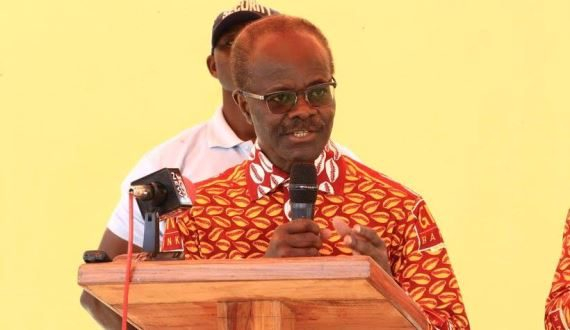

Frank Owusu-Ofori

Head, GN Corporate Affairsin a press statement