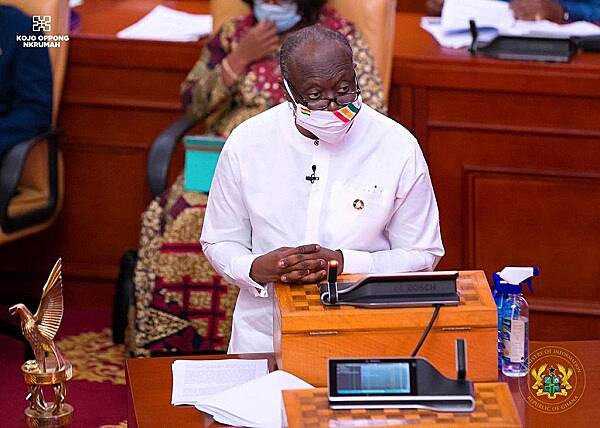

Finance Minister, Ken Ofori-Atta, has set the stage for economic revitalization with a groundbreaking tax relief strategy outlined during the presentation of the 2024 Budget Statement in Parliament.

The comprehensive list of tax reliefs, carefully curated to stimulate local industries and champion sustainable initiatives, is poised to bring about significant positive changes in the economic landscape.

The key measures introduced by Finance Minister Ken Ofori-Atta include:

- Extension of zero rate of VAT on locally manufactured African prints for two (2) more years: In a move to bolster the textile industry, the extension of the zero-rated VAT on locally produced African prints aims to boost domestic production and consumption.

- Waiver of import duties on electric vehicles for public transportation for a period of 8 years: Embracing a greener future, the government encourages the adoption of electric vehicles in public transportation by granting an 8-year import duty waiver.

- Waiver of import duties on semi-knocked down and completely knocked down Electric vehicles imported by registered EV assembly companies in Ghana for a period of 8 years: Supporting the local assembly of electric vehicles, registered companies will benefit from an 8-year import duty waiver, promoting sustainable practices.

- Extension of zero rate of VAT on locally assembled vehicles for 2 more years: Local vehicle assemblers receive continued support through an extended zero rate of VAT, fostering growth and competitiveness in the domestic automotive sector.

- Zero rate VAT on locally produced sanitary pads: Prioritizing women’s health and local manufacturing, sanitary pads produced in Ghana will now be subject to a zero-rated VAT, making them more accessible to the population.

- Granting of import duty waivers for raw materials for the local manufacture of sanitary pads: To further boost the burgeoning sanitary pad industry, the government will provide import duty waivers for essential raw materials, encouraging local production.

- Granting exemptions on the importation of agricultural machinery equipment and inputs and medical consumables, raw materials for the pharmaceutical industry: The agricultural and pharmaceutical sectors receive a significant boost through exemptions on import duties, fostering growth and sustainability.

- Introduction of a VAT flat rate of 5 percent on all commercial properties, replacing the 15 percent standard VAT rate: Simplifying administrative processes, the reduced flat rate of 5 percent VAT on commercial properties aims to support property owners and stimulate business development.